UKBullion’s Guide To Gold Investment

UKBullion’s guide to Gold Investment.

Many websites suggest investing in articles such as fine art and jewellery, however these options can leave the investor liable to pay capital gains tax upon any profit realised from their subsequent sale.

They are also subject to VAT which adds 20% to the cost of buying these items.

There is however another option which is increasing in popularity, the option to buy in to gold as gold investment.

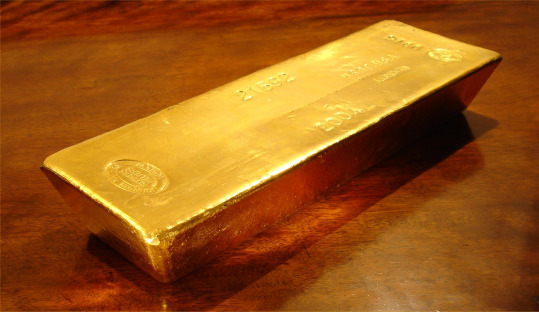

Investment Gold is defined by HMRC as “Gold that is of a purity not less than 995 thousandths that is in the form of a bar, or a wafer, of a weight accepted by the bullion markets”.

The term Investment Gold can also cover coins minted after the year 1800 that were classed as legal tender. More information about the types of gold that can be classed as Investment Gold can be found by following this link:

https://www.gov.uk/government/publications/vat-notice-70121-gold/vat-notice-70121-gold

Click to read more reasons why it may form a useful part of your investment portfolio

Investment Gold is exempt from VAT

An option often considered by investors is to invest in jewellery, however an often overlooked fact means that this can be a more costly option. VAT is added to the retail cost of jewellery which currently adds 20% to the cost of purchase and for many investors with smaller amounts can wipe out any gains made in the increase in value of the jewellery in question. Naturally there will be exceptions such as extremely rare items with a collector’s value but these will still not be exempt from VAT at the point of purchase and will most likely accrue fees associated with the auction process that will be required for them to realise their top value.

This is an area where Investment Gold in the form of Gold Bullion can have an advantage, the price per gram that is quoted on websites dealing with the price of gold is VAT free which many people do not realise. This means that you can effectively save 20% against a similar sized investment in Gold Jewellery.

Investment Gold can be free from Capital Gains Tax

Capital Gains Tax becomes a problem for high value items such as fine art which could rise in value beyond the Capital Gains tax free allowance of £11,100 for the financial year ending in 2016. This means any profit realised by the sale of items in excess of the allowance is liable for tax. For a larger portfolio of items this can very quickly cause problems when hoping to release the capital tied up in objects of fine art.

This is where Investment Gold holds another advantage.

Gold has formed the basis of currency of civilisation for many thousands of years and in some cases continues to do so. British minted Sovereigns and Britannia coins are a popular option. These coins were minted by the Royal Mint and if struck after 1837 these coins are still classed as legal tender today and as such are free from Capital Gains Tax.

Each Gold Sovereign and Gold Britannia have a value far in excess of their face value due to the gold content of the coin and with changes in the gold price could be a viable long term way of investing money. Gold prices are currently around five year lows so the value could rise increasing the value of the coins you possess. Of course the gold price can fall as well as rise and proper financial advice should be taken before making any investment decisions.

Other coins are also considered legal tender and are exempt from Capital Gains Tax so it is always a good idea to check the status of any coins you wish to purchase before investing.

Gold gives you flexibility

Investment gold is available in a wide range of forms including gold rounds, gold coins and gold bars of varying weights to suit your needs. With forward planning you should perhaps think about investing in the gold coins and weights that suit your needs. As with a fixed rate investment account you should decide how much of your capital you can happily lock away and invest that amount in as large a gold bar as possible so as to limit the fashion charges associated with gold bar production, which will be paid on each individual item you purchase adding additional costs to your investment.

The fashion charge is levied on all rounds, gold coins and gold bars and is an additional charge within the purchase price that covers the costs of production and packaging of these items.

The remainder of your investment would therefore be in the form of smaller gold bars, gold coins or rounds that are representative in value for the amount that you may need to withdraw in the event of an emergency.

The opinions contained within this article do not constitute financial advice and this should be sought independently before making any decisions regarding investments.

+ There are no comments

Add yours